Opinion:

Overseas: PMI in the US and Europe weakens, and Fed officials are hawkish. (1) PMI data in Europe and America deteriorated. The U.S. Market manufacturing PMI in August recorded 47, lower than the expected 49.3 and the previous value of 49; the initial value of the service PMI recorded 51, a new low in six months. The initial value of the PMI of the service industry in the euro zone in August recorded 48.3, a 30-month low, and fell below the line of prosperity and contraction for the first time this year. The UK manufacturing PMI recorded 42.5 in August, the lowest level in 39 months. ( 2 ) According to the US Bureau of Labor Statistics, the preliminary estimate of the number of non-agricultural employment in the United States for the year ending March this year will be revised down by 306,000. (3) Federal Reserve officials have not unified their signals on monetary policy. Boston Fed President Collins, who has voting rights at the FOMC meeting in 2025, said that further interest rate hikes may be needed, and she is not ready to signal that interest rates will peak. This year's FOMC vote committee, Philadelphia Fed Chairman Harker, predicts that interest rates may remain unchanged for the rest of this year, which may have been tightened enough. In addition, former St. Louis Fed President and big hawk Bullard said that economic growth picking up again this summer may prompt the Fed to delay the end of raising interest rates. ( 4 ) The number of initial jobless claims in the United States recorded 230,000 in the week ended August 19, a three-week low, lower than the expected 240,000. The previous value was revised down from 240,000 to 239,000, indicating that The labor market remains tight. ( 5 ) During the Jackson Hole annual meeting, Federal Reserve Powell said that if appropriate, the Fed is ready to further raise interest rates and will carefully decide whether to raise interest rates again; 2% is still and will continue to be our inflation target. Harker said that he reiterated that he does not currently believe that further interest rate hikes are needed; Mester said that June forecasts show that the Fed will not cut interest rates in 2024. Goolsbee said inflation remained higher than we expected. ( 6 ) Recently, US retail sales, new real estate starts and industrial output have been better than expected one after another, and there are even voices of economic re-acceleration ( re-acceleration ) in the market. The Atlanta Fed's GDPNow model raised its forecast for real GDP in the third quarter of the United States to 5.9% (annualized quarter-on-quarter). Pay attention to the US PCE and non-agricultural data on the evening of August 31 and September 1.

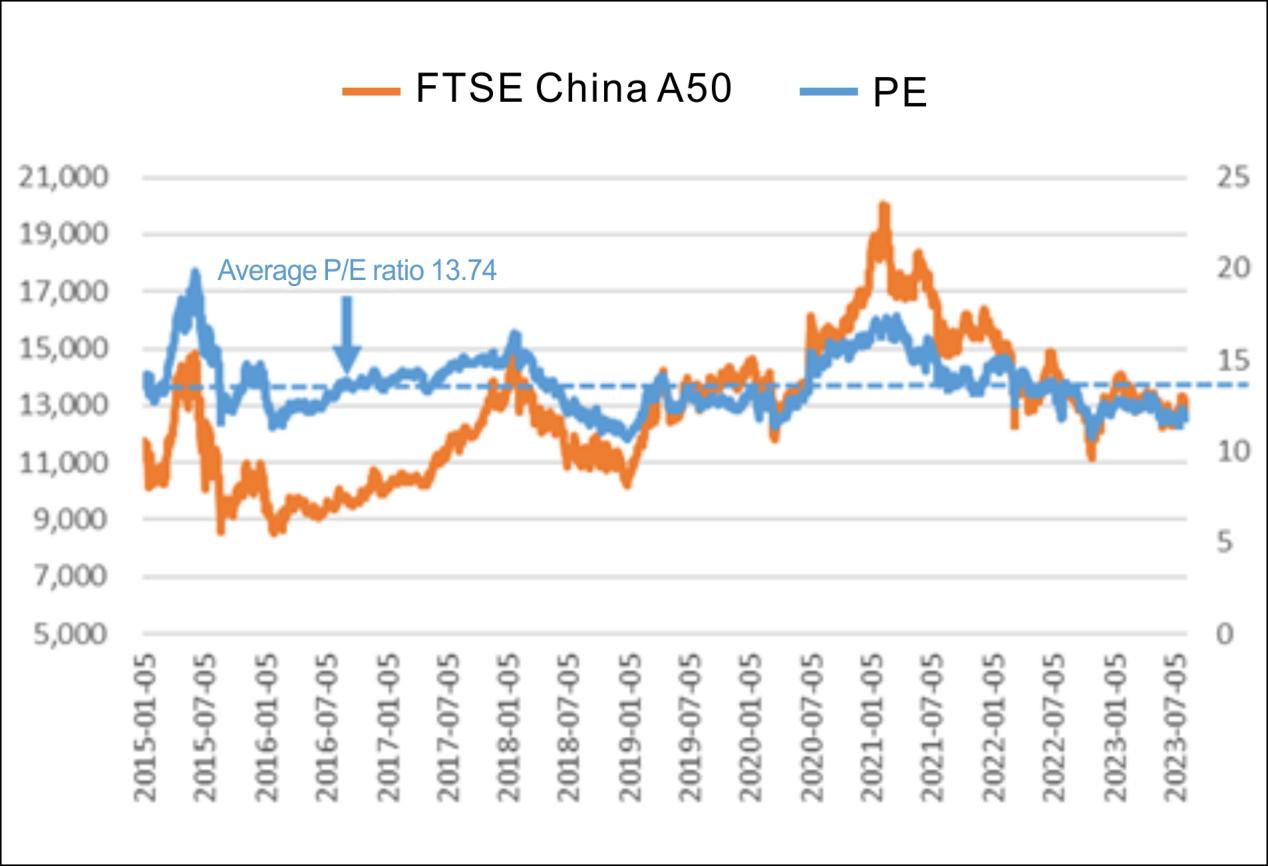

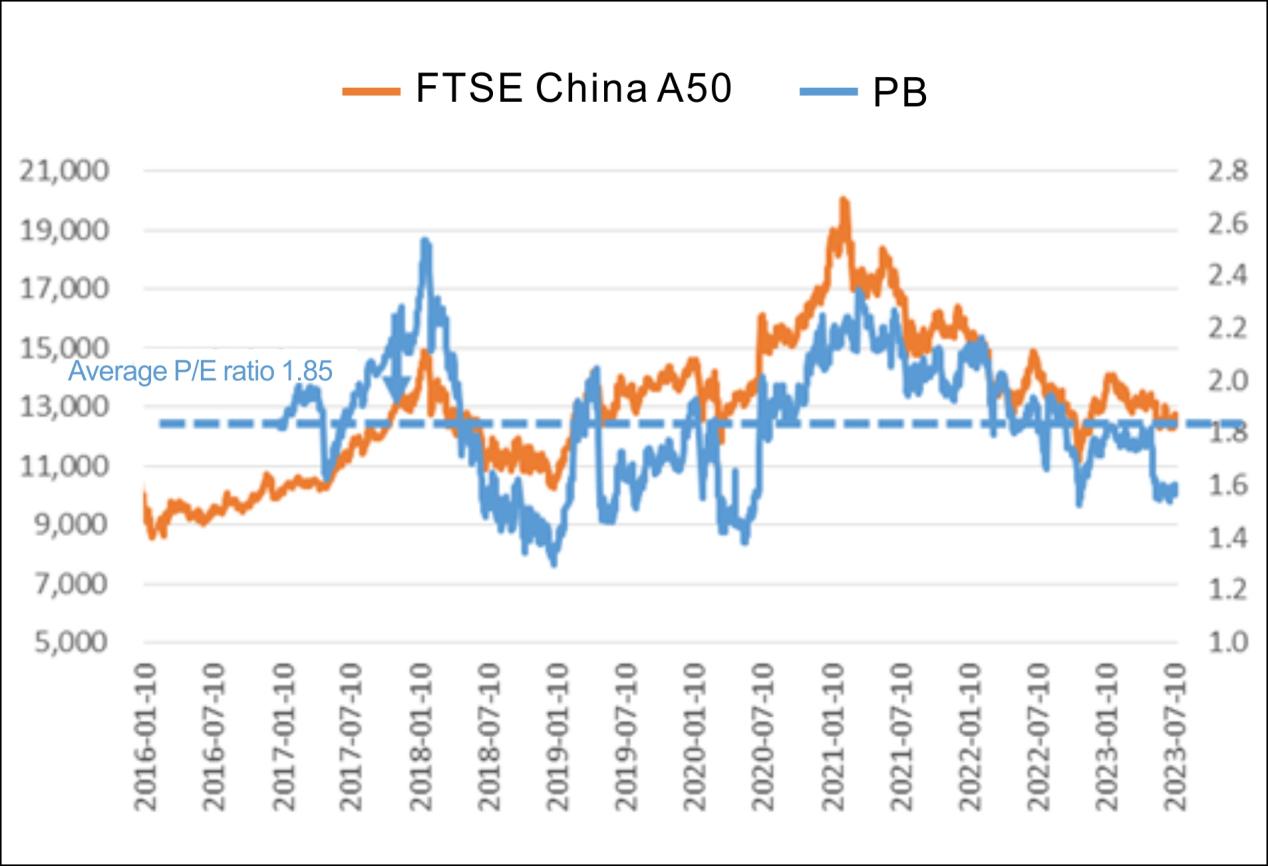

Domestic: ( 1 ) According to the Ministry of Finance and the State Administration of Taxation, starting from August 28, the stamp duty on securities transactions will be halved. Continuing to implement the tax policies related to the non-performing debts of banking financial institutions and financial asset management companies. According to the Hong Kong Stock Exchange, the adjustments made by the two departments to halve the stamp duty on securities transactions also apply to Shanghai Stock Connect and Shenzhen Stock Connect. ( 2 ) On August 25, the "Guiding Opinions on Planning and Construction of Indemnificatory Housing" reviewed and approved by the National Standing Committee pointed out that promoting the construction of affordable housing is conducive to expanding effective investment; (3) On August 25, the central bank, the Ministry of Housing and Urban-Rural Development and the Financial The State Administration of Supervision and Administration promotes the implementation of "recognize the house but not the loan" for the purchase of the first home loan, and incorporates this policy tool into the "one city, one policy" toolbox. (4) The inter-bank liquidity was tight, and the exchange rate of RMB against the US dollar was basically the same as that of the previous week. Short-term funds are still tight. Last week, inter-bank interest rates rose in general, of which R007/DR007 rose by 10.4/2.8 basis points month-on-month, respectively. Valuation (1) Market valuation: The current FTSE China A 50 valuation is relatively low. With the continuous recovery of the domestic economy, the stabilization of the RMB exchange rate, and the slowdown of overseas interest rate hikes, the attractiveness of the A-share market will increase.

In terms of A50, the stock index continued to fluctuate and fall last week, and the transaction remained low. In terms of style, the large-cap blue-chip CSI 300 and FTSE China A 50 fell less than the growth-oriented ChiNext Index, Science and Technology 50 Index, MSCI China A 50, and CSI 1000. The industry continued to fall generally, and only agriculture, forestry, animal husbandry and fishery rose slightly against the background of the stabilization of pig prices; construction, power equipment, new energy and consumer services were the largest decliners. On the domestic front, the just-introduced measures to halve the stamp duty have quickly boosted market confidence. In addition, the recent large-scale repurchase of A-shares indicates that A-shares have entered the value zone, and opportunities outweigh risks. If the subsequent economic improvement is verified or the policy strength exceeds expectations, the index is expected to return to the volatile upward channel. The index space will depend on the strength of policies and the actual effect of boosting the economy. Overseas, the U.S. economy is still resilient. Powell expressed his hawkish stance at the Jackson Hole annual meeting and continued to emphasize inflation risks. The U.S. dollar index and U.S. bond interest rates are on the strong side. It has a certain depressing effect on A shares. In the short term, due to the positive boost from the policy, valuation, sentiment and investor behavior further show the characteristics of the bottom. The opportunities at the current position outweigh the risks. It is recommended to buy at low price.

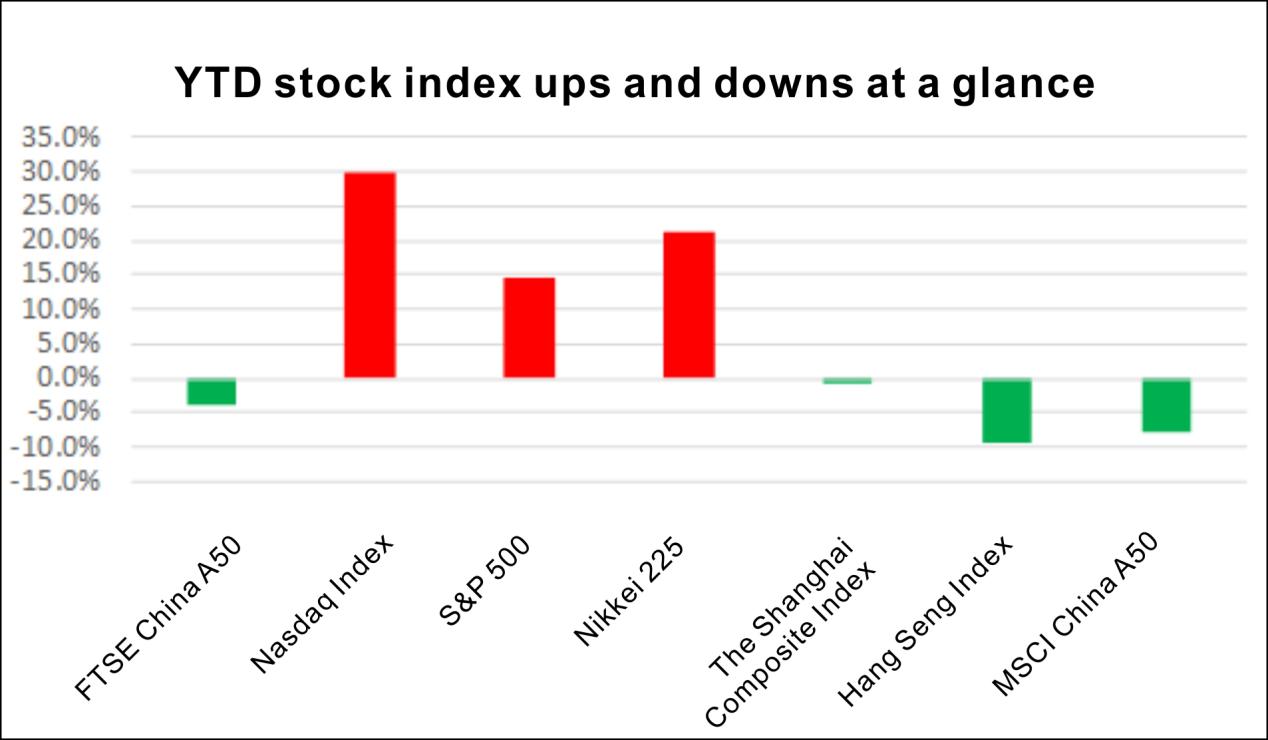

Figure 1 Year-to-date stock index rise and fall list

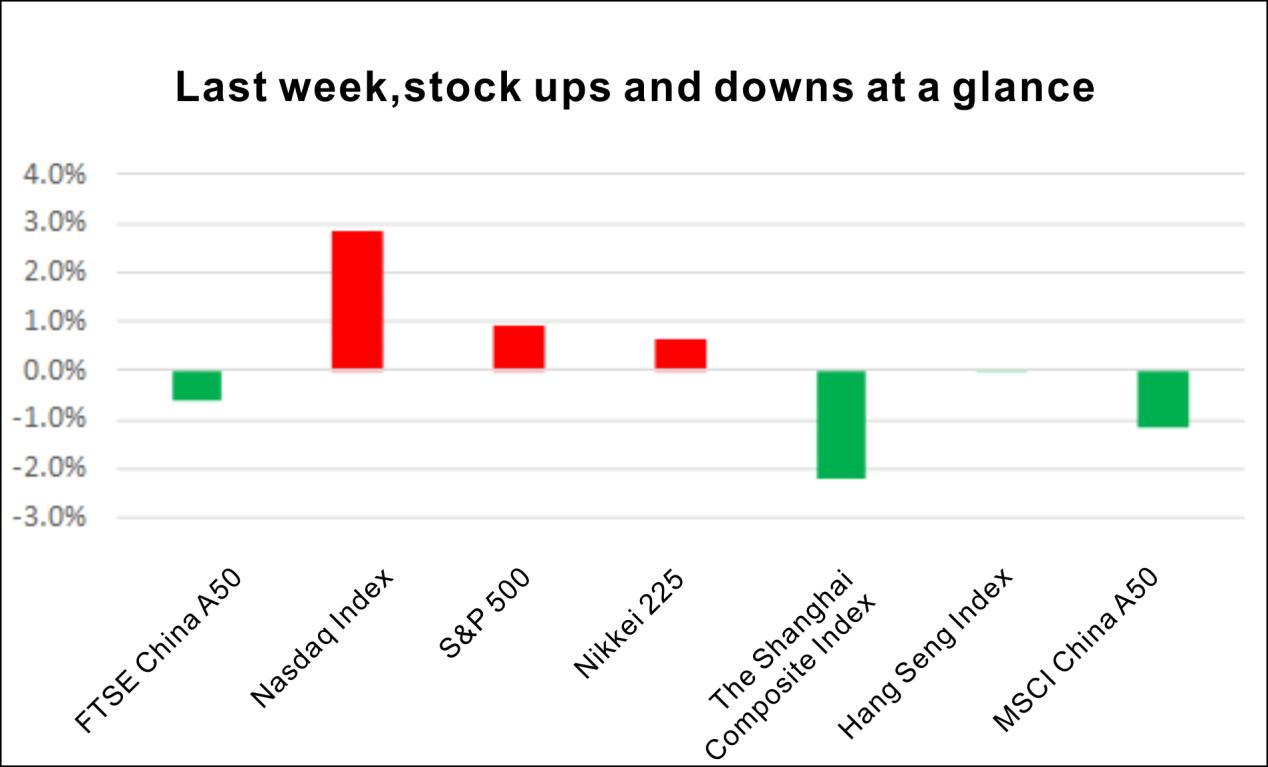

Figure 2 A list of last week's rise and fall

technical analysis

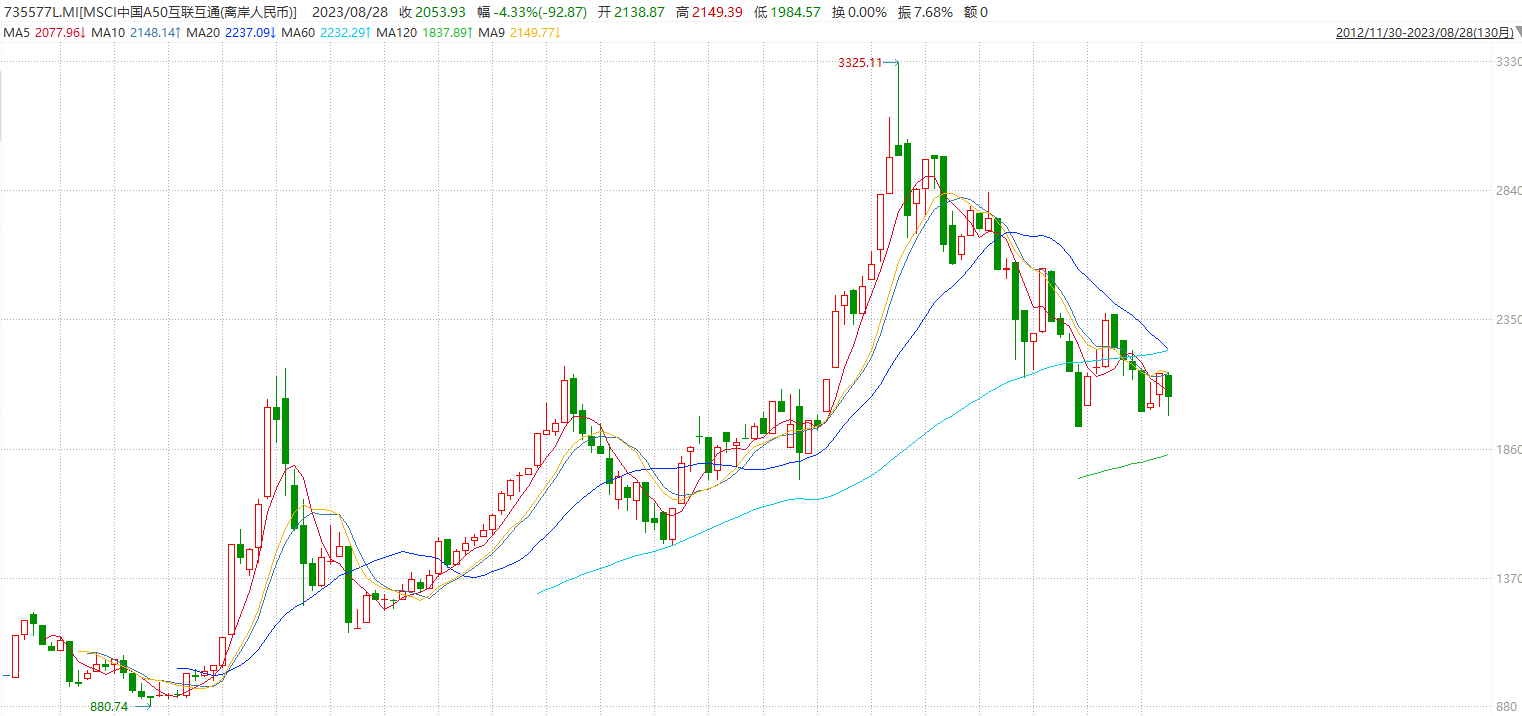

From the perspective of technical analysis, FTSE China A50 and MSCI China A50 are near the support level, and MSCI China A50 is weaker. Pay attention to the long-short performance of this position .

Figure 3 FTSE China A50 trend

Data source : Henghua International , wind

Figure 4 Trend of M SCI China A50

Data source : Henghua International , wind

Funding

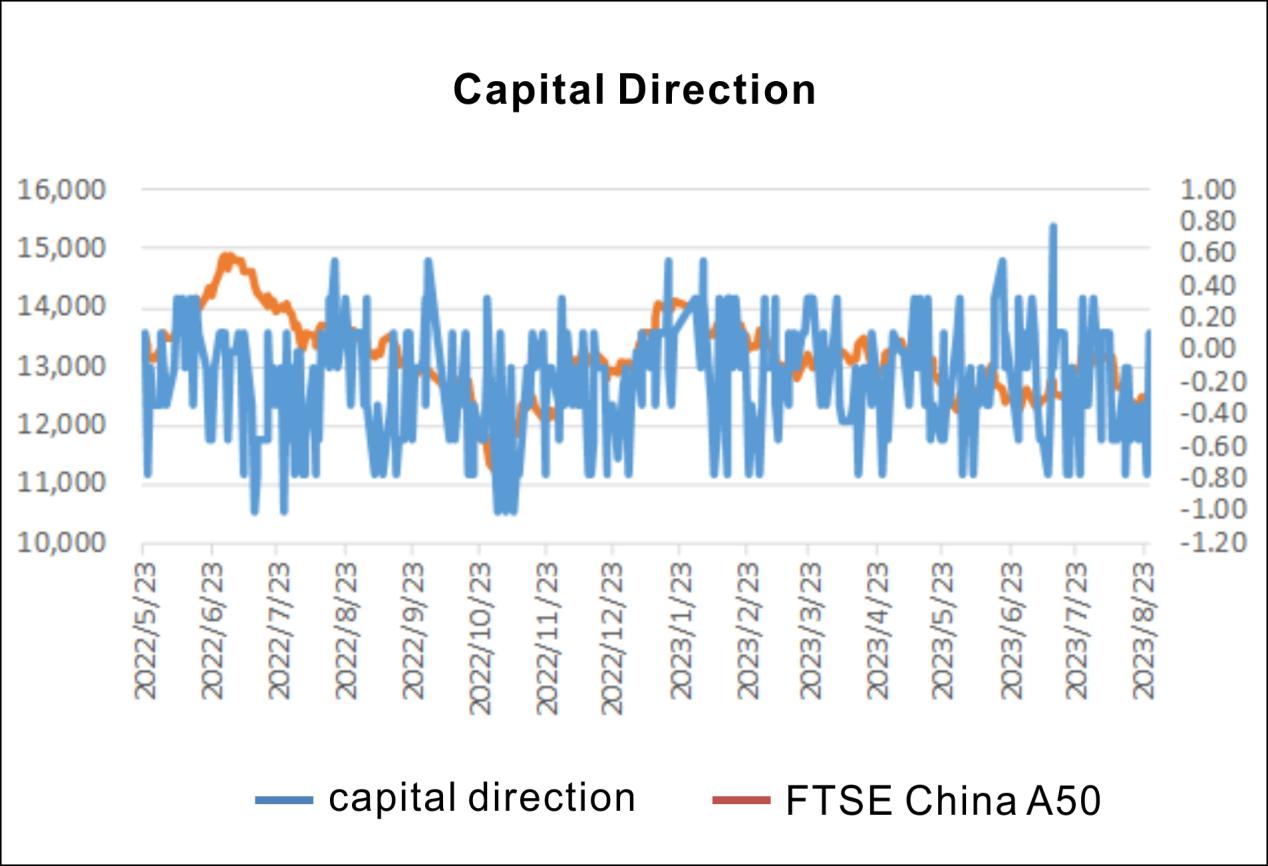

Funds in the A-share market are divided into industrial capital, foreign institutional investors (northbound funds), domestic institutional investors (public funds, trusts, private equity, brokerage asset management, insurance), domestic individual investors, and leveraged funds . According to Huatai Securities Metalworking's test on capital indicators, the following nine indicators have the highest correlation with the trend of A shares. Therefore, use 9 indicators to build a multi-indicator timing strategy: sum up the original signals of the indicators [ -1,1], when the signal < -0.5, open a short position, and when the signal > =0, close the position. When the signal > 0.5, open a long position, and when the signal < = 0, close the position. Current capital signal = -0.33, no open position signal.

Last week, the overall net outflow of market funds: Among them, the net outflow of northbound funds ; the net outflow of leveraged funds, the net outflow of margin financing and securities lending balances, the net outflow of margin financing and securities lending transaction amounts; the overall net outflow of industrial capital, the total increase of executives, the increase of executives Net outflow of holding /reduction of holdings, net outflow of stock repurchase implementation amount; net inflow of newly issued securities investment trust scale of trust; net outflow of private equity fund issuance scale.

Figure 5 Funds and A50 Trends

Index Valuation

The current PE is at the 8 % percentile since 2015 , and the PB is at the 20% percentile since 2015, and the valuation is low.

Compared with other global indexes, with the continuous recovery of China's economy and the cooling of the Fed's interest rate hike, the A-share index has become more attractive to overseas funds .

Calculation formula : price-earnings ratio PE (TTM) = 1/SUM (Wi/PEi), price-to-book ratio PB (TTM) = 1/SUM (Wi/PBi) , return on equity ROE = PB/PE .

Figure 6 Valuation analysis of each index

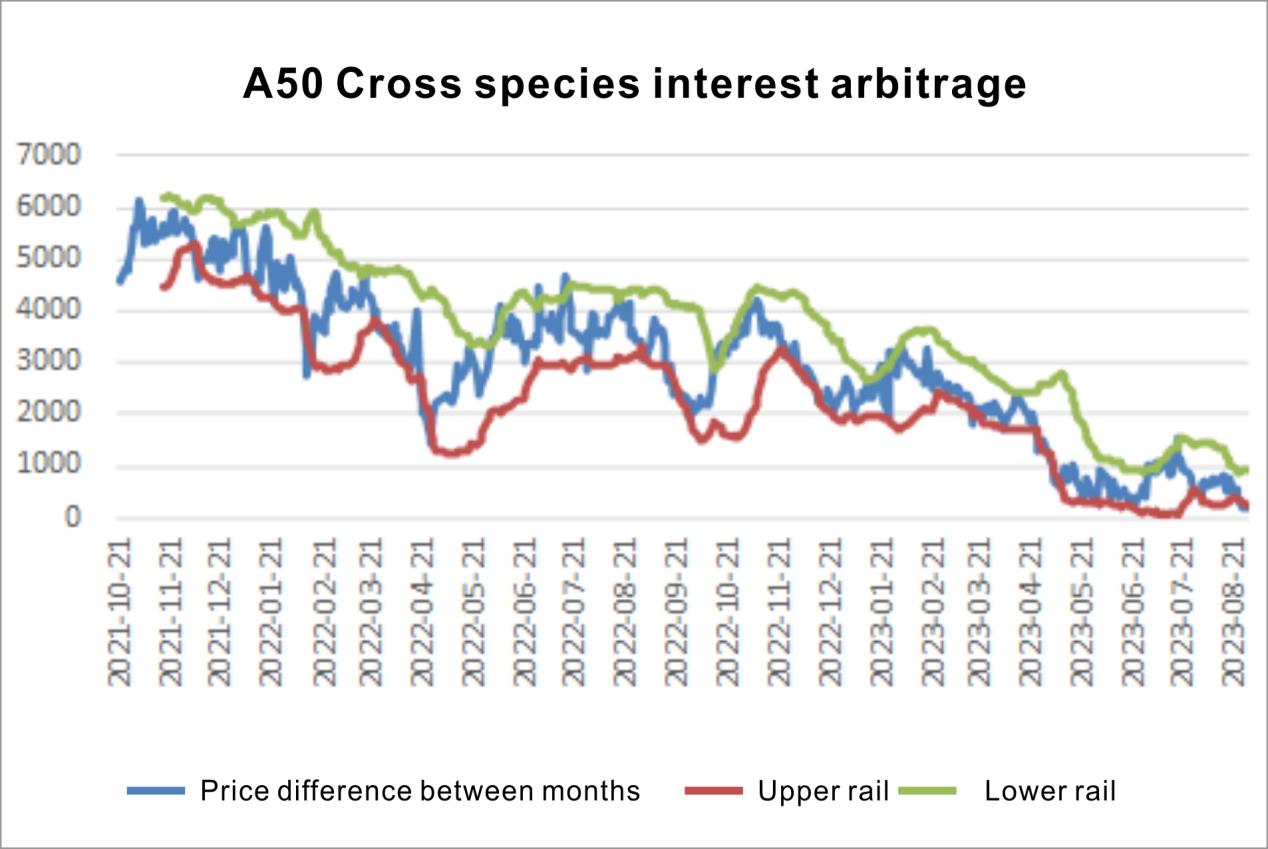

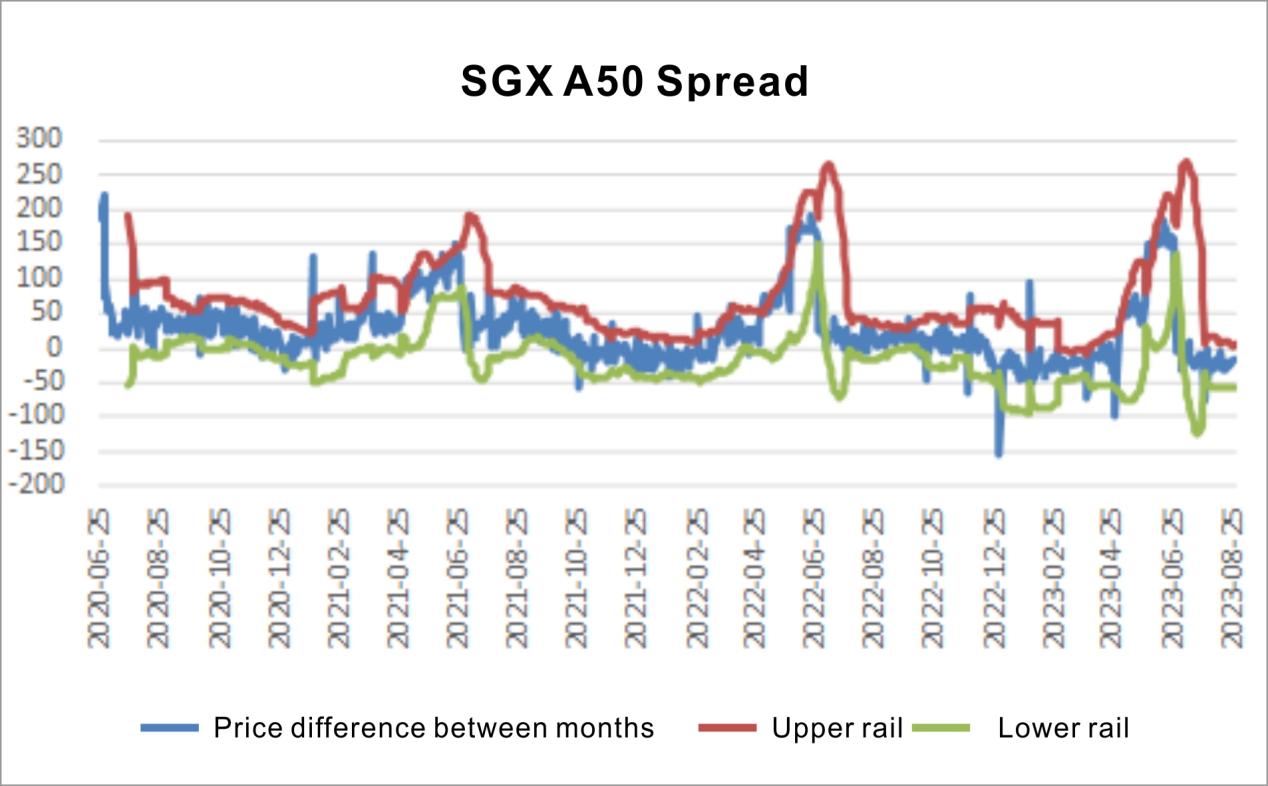

Spread analysis

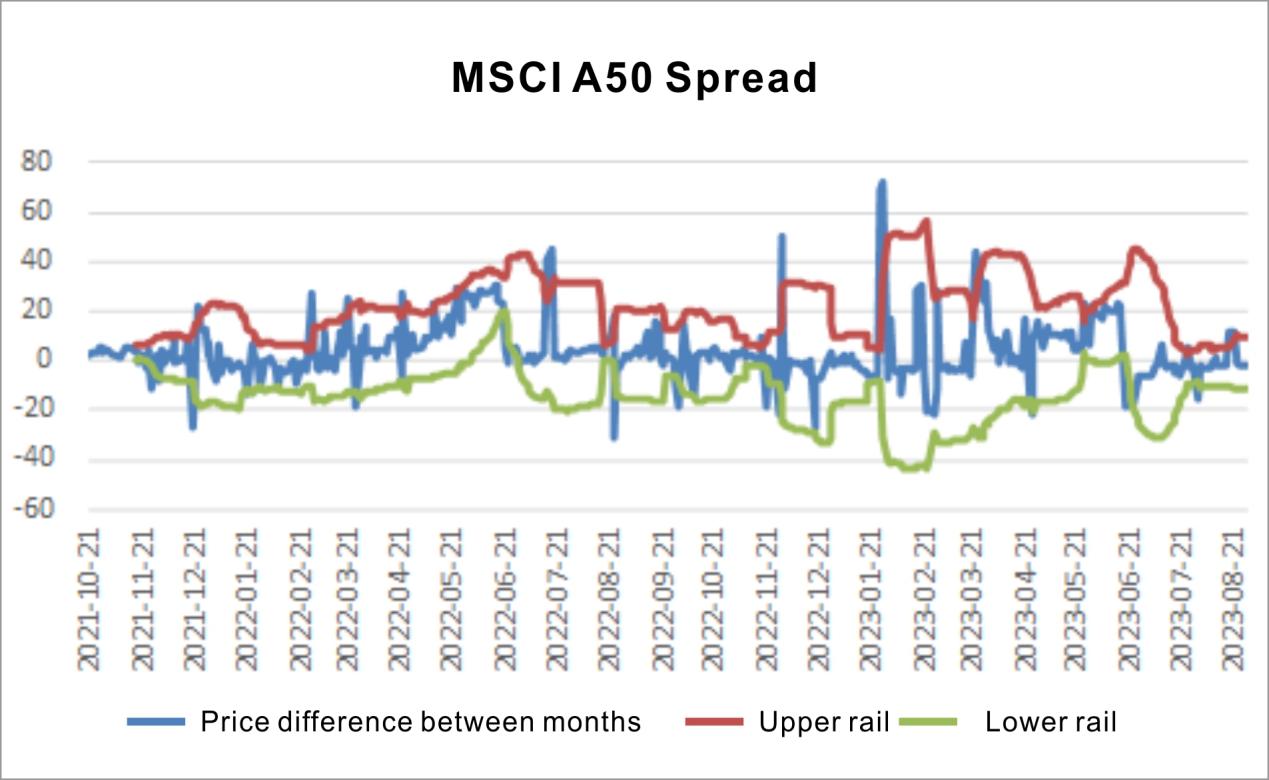

Intertemporal arbitrage: The upper and lower Bollinger band ranges of the FTSE China A 50-month price difference: [ -58, 5], the upper and lower Bollinger band ranges of the M SCI China A 50-month price difference: [ -12, 10], It is recommended that the price difference break through this range for arbitrage.

Cross-variety arbitrage: S GXA50- M SCI China A 50 cross-species price spread Bollinger upper and lower track range: [ 223,924], the current cross-species is in a unilateral market, it is recommended to wait and see.

Figure 7 Application of Bollinger Orbits in FTSE China A 50- month spread

Figure 8 The application of Bollinger orbits in the MSCI China A 50- month price difference

Figure 9 The application of Bollinger orbit in S GXA50- M SCI China A 50 cross-species price difference