Opinion:

Overseas: The market has fully priced in the interest rate hike in July, and will pay attention to whether it will continue to raise interest rates in September. (1) The number of initial jobless claims in the United States recorded 228,000 in the week ending July 15, lower than the expected 242,000 and the previous value of 237,000, the lowest since the week of May 13, 2023. Expectations in the swap market for further rate hikes by the Fed after July have grown. (2) The monthly rate of retail sales in the United States recorded 0.2% in June, the third consecutive month of growth, lower than the expected 0.5%, and the previous value was revised up from 0.3% to 0.5%. Following the data, traders were fully pricing in a 25 basis point rate hike from the Federal Reserve next week. U.S. industrial output recorded a monthly rate of -0.5% in June, the largest drop since December 2022. (3) Goldman Sachs believes that July will be the last rate hike by the Federal Reserve in this round, and predicts that the probability of a US recession in the next 12 months is 20%.

Domestic: Pay attention to the progress of economic recovery, and policy support is still the key. (1) China's GDP grew by 5.5% year-on-year in the first half of the year, and 6.3% in the second quarter, lower than market expectations; national real estate development investment fell by 7.9% year-on-year. In June, the national surveyed urban unemployment rate was 5.2%, and the youth unemployment rate was 21.3%. (2) The Central Committee of the Communist Party of China and the State Council issued the "Opinions on Promoting the Development and Growth of the Private Economy". The "Opinions" pointed out that "the private economy is a new force to promote Chinese-style modernization and an important foundation for high-quality development." It is necessary to adhere to the "two unshakable" and specifically propose 31 policy measures in 7 aspects including optimizing the development environment of the private economy, increasing policy support for the private economy, strengthening legal protection for the development of the private economy, and focusing on promoting the high-quality development of the private economy. (3) Intensive introduction of policies to stabilize growth and promote consumption. The Ministry of Commerce and other 13 departments jointly issued a number of measures to promote household consumption. The notice proposed to vigorously improve the quality of supply, actively innovate consumption scenarios, effectively improve consumption conditions, focus on optimizing the consumption environment, and put forward targeted measures and suggestions; the Ministry of Commerce stated that it will further relax the restrictions on foreign investors' strategic investment in listed companies, research and support new energy vehicles to develop international markets; the National Development and Reform Commission issued a document to promote the consumption of electronic products and strongly support the sending of electronic products to the countryside. (4) The central bank and SAFE raised the macro-prudential adjustment parameters for cross-border financing. On July 20, the central bank and the State Administration of Foreign Exchange announced that in order to further improve the macro-prudential management of full-scale cross-border financing, continue to increase the sources of cross-border funds of enterprises and financial institutions, guide them to optimize the structure of assets and liabilities, and increase the macro-prudential adjustment parameters of cross-border financing of enterprises and financial institutions from 1.25 to 1.5, which will be implemented on the same day. The increase in parameters is conducive to releasing the liquidity of the US dollar, easing the pressure of RMB depreciation, and reasonably guiding the market's expectations on the RMB exchange rate. (5) The National Standing Committee deliberated and approved the "Guiding Opinions on Actively and Steadily Promoting the Transformation of Urban Villages in Megacities". The "Opinions" propose that the active and steady implementation of urban village transformation in megacities is an important measure to improve people's livelihood, expand domestic demand, and promote high-quality urban development. It is necessary to increase policy support for the transformation of urban villages, actively innovate the transformation model, and encourage and support the participation of private capital. (5) China and the United States maintain active dialogue. The US President's special envoy for climate issues, Kerry, recently visited China to exchange views on cooperation in tackling climate change. On July 20, President Xi Jinping met with former U.S. Secretary of State Henry Kissinger, and emphasized that "on the basis of following the three principles of mutual respect, peaceful coexistence, and win-win cooperation, China is willing to discuss with the U.S. the way for the two countries to get along correctly and promote the steady development of Sino-U.S. relations." (6) Market valuation: The current FTSE China A 50 valuation is relatively low. With the continuous recovery of the domestic economy, the stabilization of the RMB exchange rate, and the slowdown of overseas interest rate hikes, the attractiveness of the A-share market will increase.

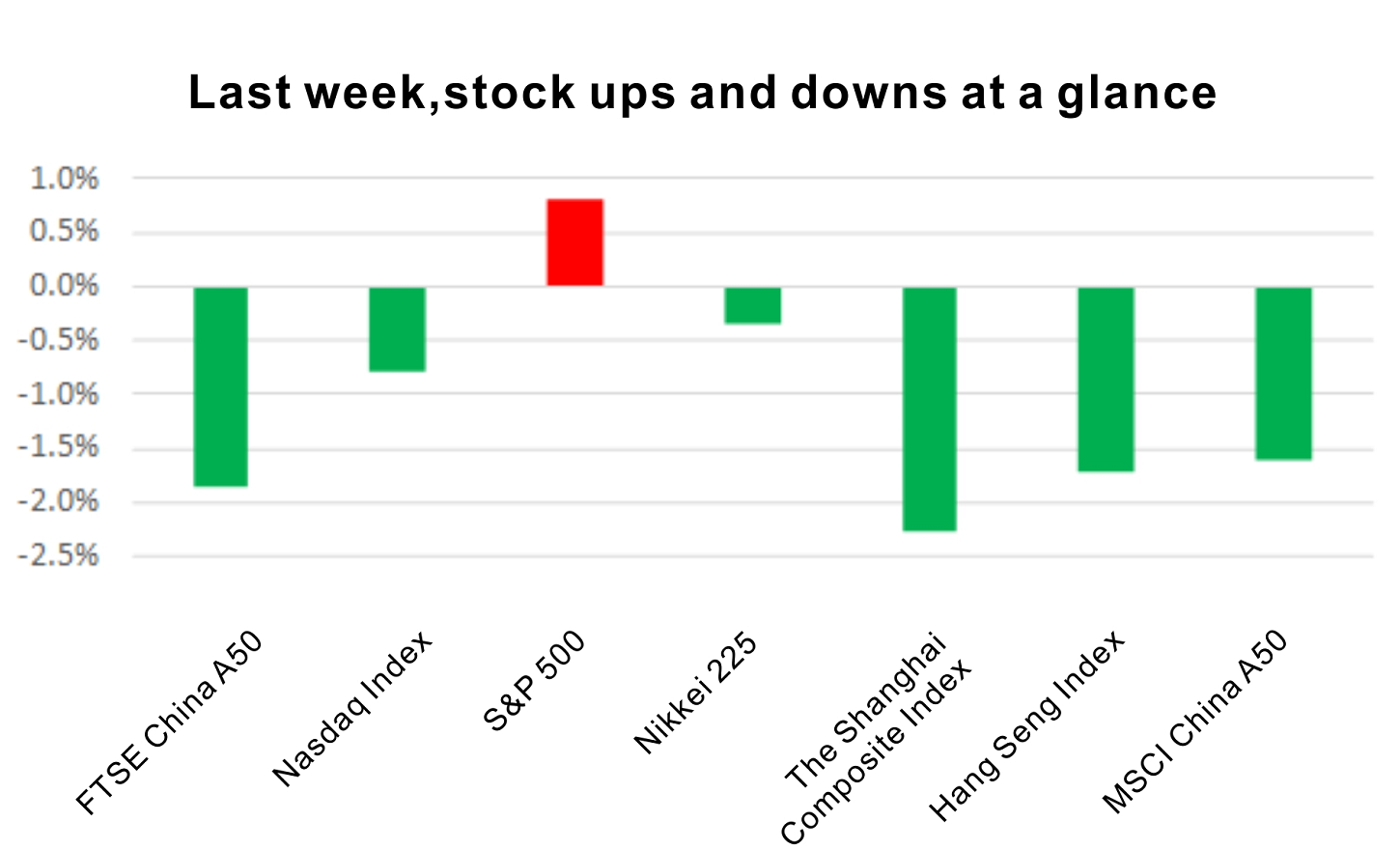

In terms of A50, the stock index dropped from its high level last week, and the transaction remained low. In terms of industries, most of Shenwan's first-tier industries fell, and industry differences increased significantly. Combined with the weight of the industry, power equipment and electronics are the main reasons for the decline of various stock indexes. At the same time, non-bank finance dragged down the A 50, CSI 30 0 and SSE 50. At the style level, the value style outperforms growth, and the market value style is larger. Overseas, the Federal Reserve’s interest rate hike in July was within market expectations , the pressure on RMB depreciation has eased, and market risk appetite has picked up significantly . Domestically, the data in June generally declined, and the Q2 GDP growth rate was lower than expected. However, in terms of policy, loose policies have been implemented one after another. The central bank stated that it will continue to increase policy counter-cyclical adjustments, and deposit and loan interest rates are expected to continue to be lowered. At the same time, the central bank and the State Administration of Foreign Exchange raised the macro-prudential adjustment parameters for cross-border financing of enterprises and financial institutions from 1.25 to 1.5, and emphasized that the response to exchange rate fluctuations will neither be determined nor too Buddhist. Secondly, policies to stimulate domestic demand have been introduced one after another, such as new energy vehicles going to the countryside, purchase tax incentives, and home appliance consumption stimulation. The recent National Standing Committee pointed out that in megacities, we should actively and steadily promote the construction of public infrastructure for both emergency and emergency use, and actively and steadily implement the transformation of urban villages. In the short term, combined with the recovery of risk appetite in overseas markets, the continuous efforts of domestic policies to stabilize growth, and the current low valuation advantage, there is a chance for the market to rebound, and it is recommended to do more on dips. Interval range: FTSE A 50 [ 1 1158, 1 3000], MSCI China A 50 [1929, 2 100].

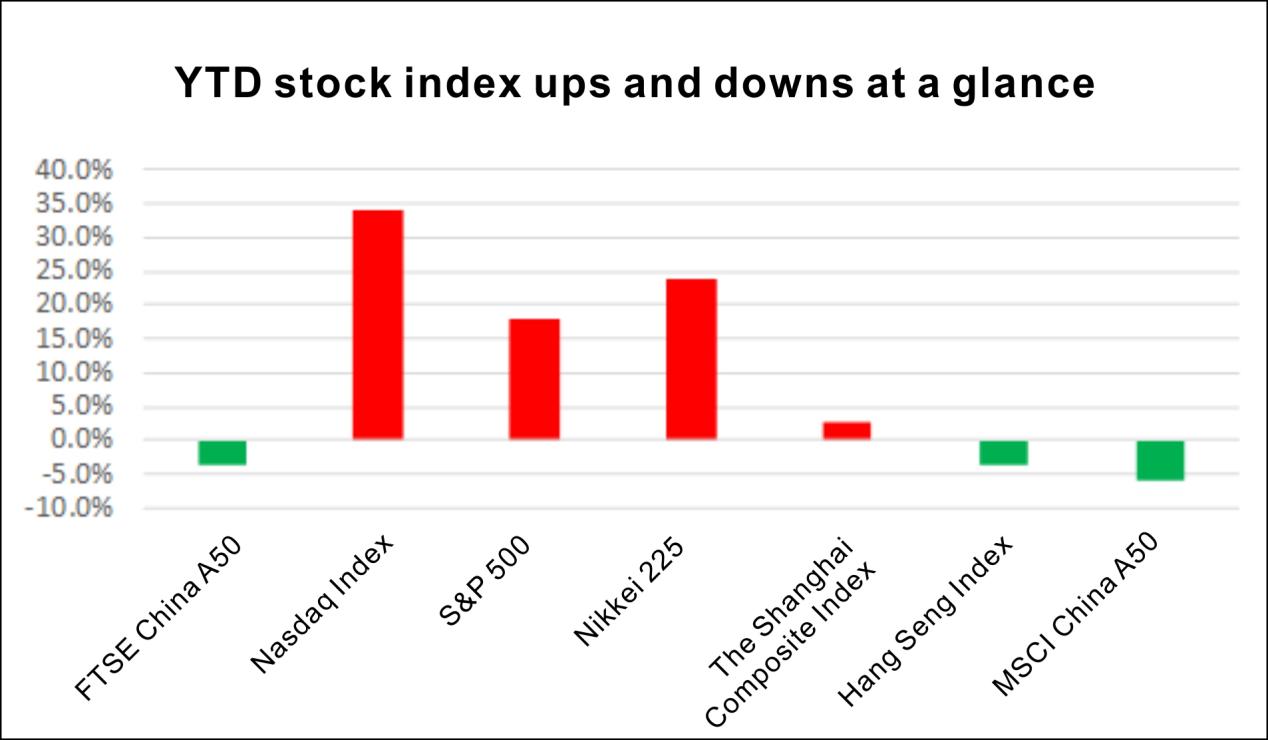

Figure 1 Year-to-date stock index rise and fall list

Figure 2 A list of last week's rise and fall

Technical Analysis

From the point of view of technical analysis, FTSE China A50 and MSCI China A50 are currently falling below the support level of 12800 and 2080 , focusing on the lows of 11158 and 1929 at the end of last year.

Figure 3 FTSE China A50 trend

Figure 4 Trend of MSCI China A50

Funding

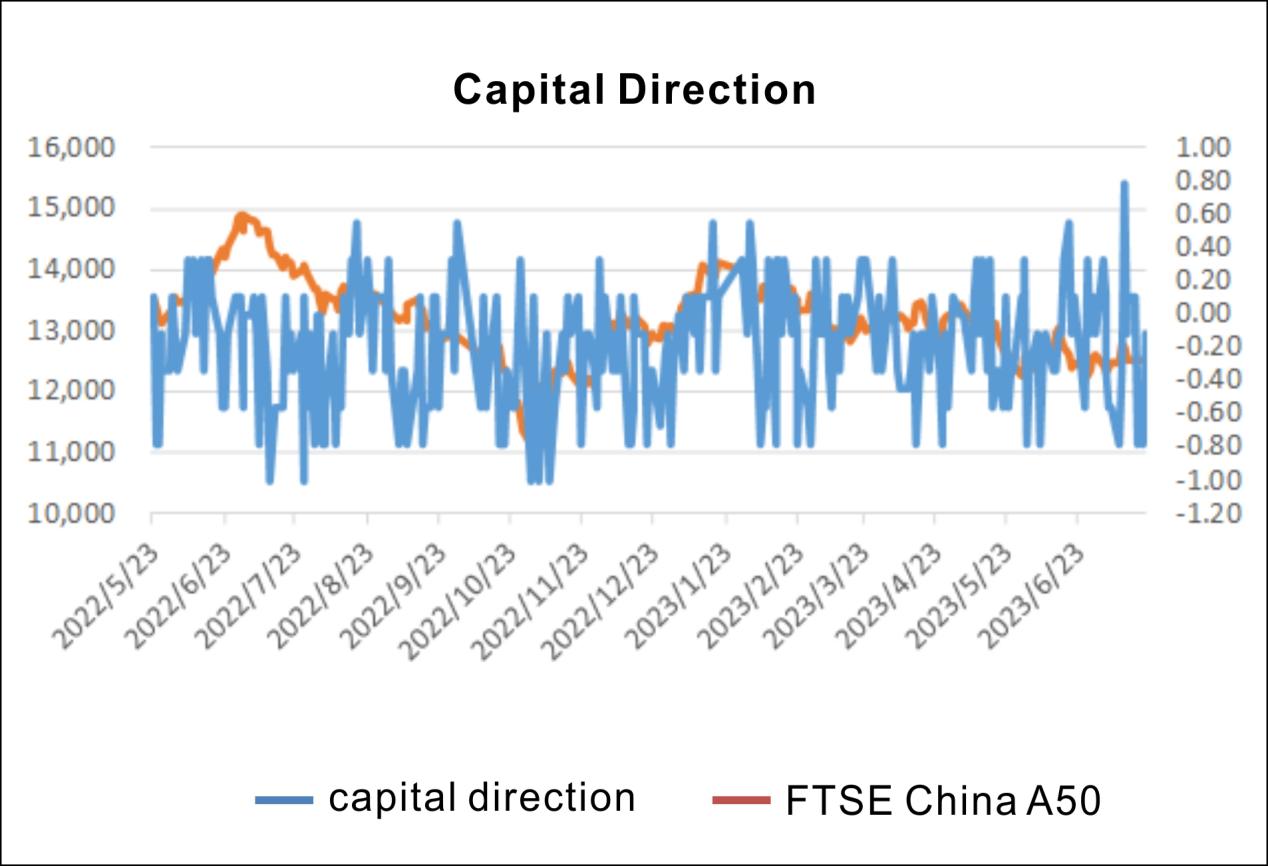

Funds in the A-share market are divided into industrial capital, foreign institutional investors (northbound funds), domestic institutional investors (public funds, trusts, private equity, brokerage asset management, insurance), domestic individual investors, and leveraged funds . According to Huatai Securities Metalworking's test on capital indicators, the following nine indicators have the highest correlation with the trend of A shares. Therefore, use 9 indicators to build a multi-indicator timing strategy: add up the original signals of the indicators [ -1,1], when the signal < -0.5, open a short position, and when the signal > =0, close the position. When the signal > 0.5, open a long position, and when the signal < = 0, close the position. The current capital signal = -0.78, a signal to open a short position.

Last week, the overall net outflow of market funds: Among them, the net inflow of northbound funds ; the net inflow of leveraged funds, the net outflow of margin financing and securities lending balances, and the net outflow of margin trading and securities lending transaction amounts; the overall net outflow of industrial capital, the total increase in executives’ holdings, the net outflow of executives’ holdings increasing/reducing holdings, and the net outflow of stock repurchase implementation amounts; the net outflow of newly issued securities investment trusts by trusts; the net inflow of private equity private equity funds.

Figure 5 Funds and A50 Trends

Index Valuation

Compared with other global indexes, with the continuous recovery of China's economy and the cooling of the Fed's interest rate hike, the A-share index has become more attractive to overseas funds.

Calculation formula : price-earnings ratio PE (TTM) = 1/SUM (Wi/PEi), price-to-book ratio PB (TTM) = 1/SUM (Wi/PBi) , return on equity ROE = PB/PE.

Figure 6 Valuation analysis of each index

Spread Analysis

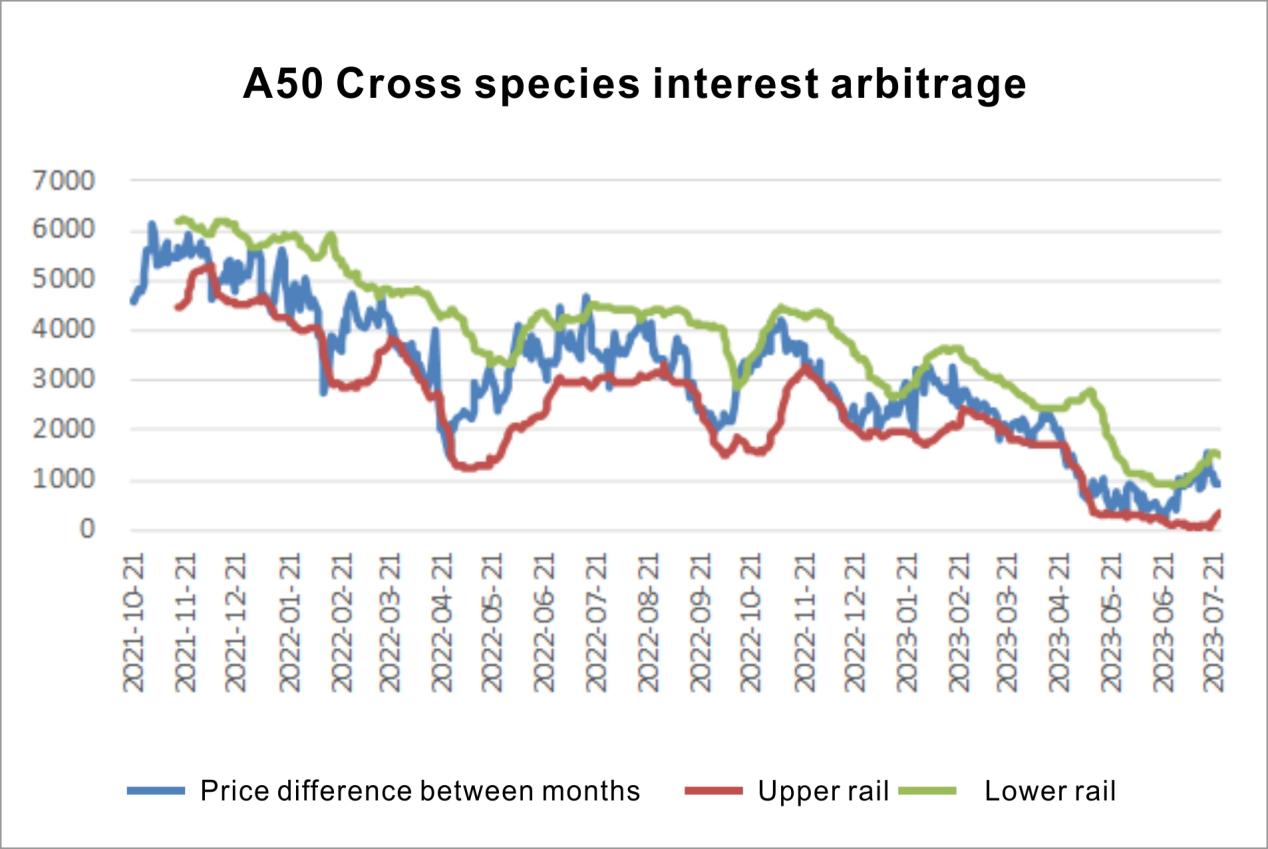

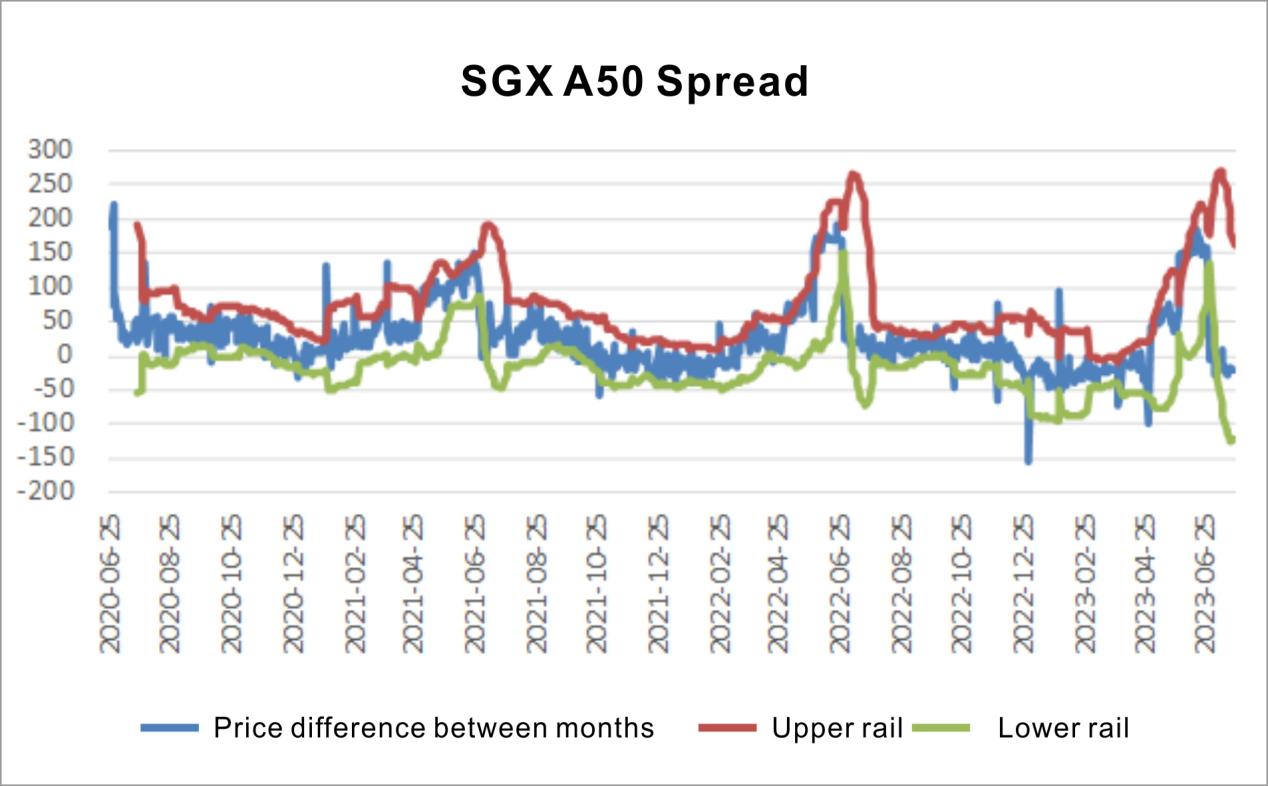

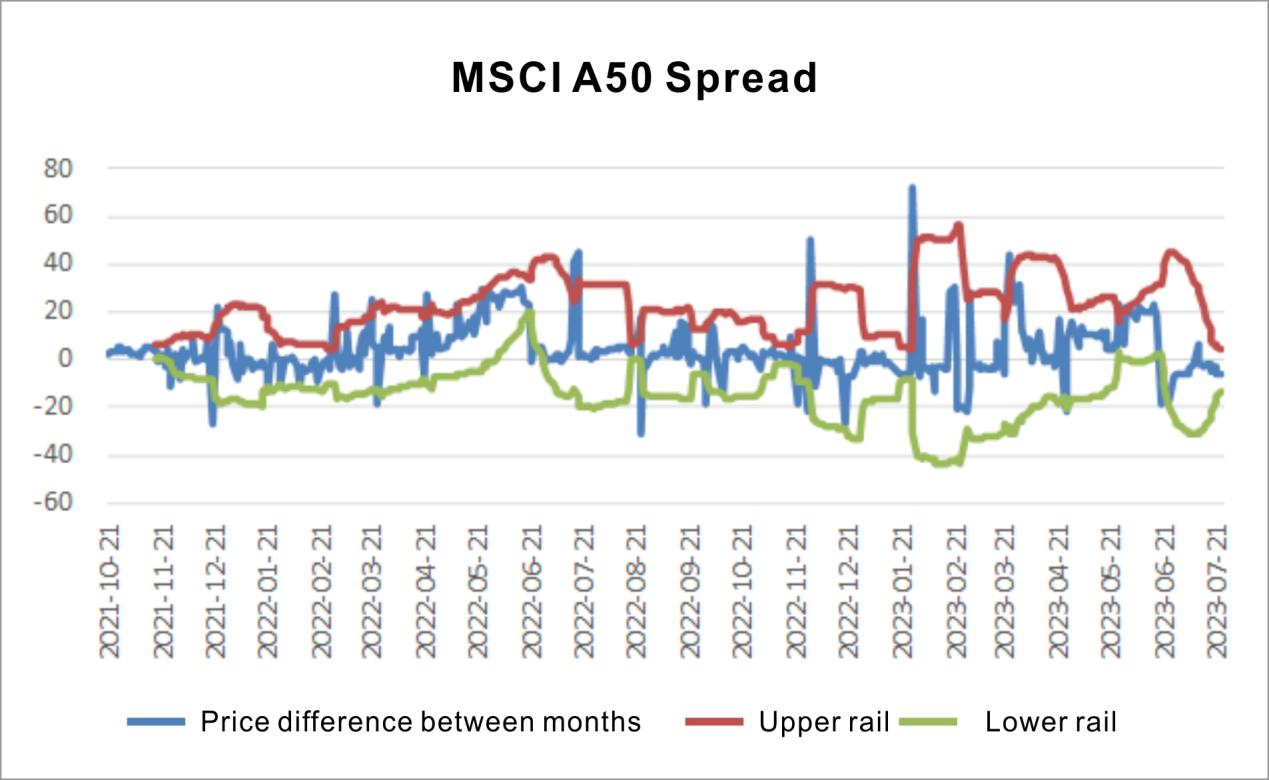

Intertemporal arbitrage: The upper and lower Bollinger band ranges of the FTSE China A 50-month price difference: [ -122, 163], the upper and lower Bollinger band ranges of the M SCI China A 50-month price difference: [ -13, 5]. It is recommended that the price difference break through this range for arbitrage.

Cross-variety arbitrage: SGXA50- M SCI China A 50 cross-species price spread Bollinger upper and lower track range: [357, 1488], the current cross-species is in a unilateral market, it is recommended to wait and see.

Figure 7 Application of Bollinger Orbits in FTSE China A 50- month spread

Figure 8 The application of Bollinger orbits in the MSCI China A 50- month price difference

Figure 9 The application of Bollinger orbit in S GXA50- M SCI China A 50 cross-species price difference