Market Trend

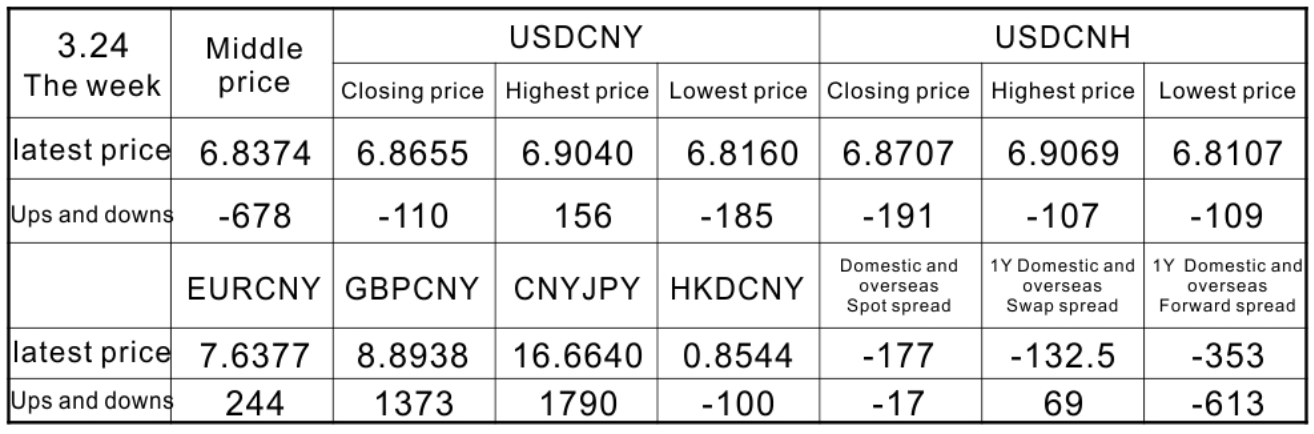

The USD/CNY mid-price was at 6.8374 on Friday (March 24), with the RMB mid-price down 678pips from last week (March 17), CNY closed at 6.8655 at 16:30 last week, CNH closed at 6.8707 last week, down 110pips and down 191pips respectively from last week. The spread between domestic and overseas spot and 1-year forwards was -16pips and 283pips respectively as of 5pm on Friday, while the euro was at 7.3815 against the yuan, the pound was at 8.3921 against the yuan, the yuan was at 18.9902 against the yen and the Australian dollar was at 4.5588 against the yuan, appreciating 558pips, appreciating 246pips, depreciating 1924pips and depreciating 440pips respectively compared to last week.

Wind data shows that this week the central bank open market will have 350 billion yuan reverse repo expiry, of which 30 billion yuan, 182 billion yuan, 67 billion yuan, 64 billion yuan, 7 billion yuan from Monday to Friday respectively. On the funding side, interbank market liquidity became more accommodative on Friday, with abundant supply of funds during the month. The weighted overnight and seven-day repo rates fell sharply, with the weighted average overnight repo rate down 26.4bp at 1.2697% and the weighted average seven-day repo rate down 21.96bp at 1.6982%. In terms of long-term funding, the latest issue price of one-year interbank certificates of deposit of national and major joint-stock banks was concentrated near 2.60%; in terms of secondary transactions, the one-year interbank certificates of deposit of national and major joint-stock banks were maintained near 2.68%. The company's main business is to provide a wide range of products and services to its customers. Sichuan Securities pointed out that it is expected that after the landing of the downgrade, the stock market and bond market will usher in a positive, can focus on the banking, real estate sector. For the stock market, the downgrade provides credit support for various industries and stimulates economic growth, and the economic fundamentals are good, which plays a boost to the stock market, and the downgrade also boosts investor confidence. Experts say that with the help of long-term funds released by the downgrade, liquidity will remain reasonably plentiful and smooth across the season. In addition, there is still a possibility and space for continued downgrades during the year. The central bank will use more structural monetary policy tools to support the real economy. March LPR quotes held steady, with 1-year LPR quoted at 3.65%, compared to 3.65% last time, and 5-year+ varieties quoted at 4.30%, compared to 4.30% last time. The data shows that since the asymmetric downward adjustment of LPR in August 2022, LPR has been "unchanged" for seven consecutive months. March LPR quotes were unchanged from last month, basically in line with market expectations, which had less impact on the debt market. The effect of the tightening of the funding surface may be seen sooner, and the pattern may usher in marginal relief; for the bond market, the medium-term perspective on the long bond rates or continue to run on the strong side of the oscillation.

Key Data and Event Interpretation

1.The Fed raised rates by 25 basis points in March, in line with our expectations. The monetary policy statement implied that rate hikes are nearing their end and the recent banking turmoil has reduced the need for further rate hikes in the future. However, with inflation resilient, a rate cut is not imminent and the Fed's guidance for rates to stay high for longer remains in place. Overall, the Fed believes that the stronger than expected economic data since the beginning of the year and the recent banking turmoil roughly "pay for themselves" and that it is better to wait and see if there is a need to either raise rates too much more or cut rates soon.

Interpretation: Rate hike nears 'finish line', dot plot suggests another hike within the year In its latest policy statement, the Fed revised its statement on the path of monetary policy, replacing "a sustained increase in the target range for interest rates is appropriate" with "some additional policy tightening may be appropriate", suggesting that interest rate hikes are nearing the target rate. The target rate. Powell also re-emphasised the words "some" and "may" at the press conference, indicating that the Fed wants to maintain greater flexibility on the future path of interest rate hikes, especially for the next meeting. Looking at the dot plot, Fed officials left their median forecast for the federal funds rate unchanged at 5.1% at the end of 2023, which may mean the last 25 basis points of rate hikes ahead as rates have now been raised to 4.75-5.0%. The recent banking turmoil has reduced the need for further rate hikes in the future. Powell said during the Congressional hearing on 7 March that the end point for interest rates was likely to be higher than expected at the end of last year, but this meeting has signalled that rate hikes are nearing an end, with the turning point being the recent series of banking risk events. The Fed believes that the banking sector turmoil will lead to banks spontaneously "tightening credit", which can replace part of the work of raising interest rates, so that the Fed does not need to raise rates more. But a rate cut is not coming soon either, and the guidance for rates to stay high for longer is still in place. The latest dot plot is not much changed from last December, with Fed officials leaving the median fed funds rate forecast unchanged at 5.1% at the end of 2023 and even raising the forecast to 4.3% at the end of 2024 (from 4.1% previously), suggesting that Fed officials are still not thinking of cutting rates this year and are restrained in how much they will cut rates next year. We believe this is mainly because the economy and inflation remain resilient. The Fed noted in its monetary policy statement that recent data showed that "job growth has picked up", while in describing the progress of inflation, it removed the phrase "inflation has eased somewhat". When describing the progress of inflation, the phrase "inflation has eased somewhat" was deleted and only the phrase "inflation remains elevated" was retained. This suggests that the Fed believes that the task of "fighting inflation" is not yet complete and that there is still a long way to go before inflation returns to 2%. In general, the Fed believes that the stronger-than-expected economic data since the beginning of the year and the recent banking turmoil have roughly "more than compensated" for each other, and that it neither needs to raise interest rates too much nor needs to cut them soon, so it is better to wait and see. Considering that the banking fiasco has just fermented, it is not known how big the impact is, the Fed may be inclined to act cautiously, for the time being, it does not need to speed up rate hikes to curb high inflation, nor does it need to cut rates to save the economy from the fire. But from Powell's statement can be seen, the Fed for the evolution of the banking sector storm is still in a state of high alert, Powell also continued to emphasize that the Fed is a thorough review of relevant banking events, the results of the review will provide more basis for future monetary policy decisions. Compared to the Fed's "calmness", the market did not recognise it and asset price movements reflected more pessimistic expectations for the future. Although Powell has repeatedly stressed that there will be no rate cuts in 2023 under the base case scenario, the interest rate futures market is currently factoring in expectations that the Fed will cut rates from mid-year, according to which the federal funds rate will fall to around 3% by mid-2024, a far cry from the 4.3% shown on the Fed's dot plot. In addition, US bond yields generally moved lower after the rate meeting, the US dollar index fell and the three major US stock indices plunged, suggesting that the market may or may not also believe that the Fed's rate cut is expected to act as a floor for risk assets. Why is there a divergence? The reason is that the two sides have different perceptions of the impact of the current round of banking turmoil. The market believes that the impact of the banking turmoil may be non-linear, the slightest mistake will lead to a sharp decline in the U.S. economy, unemployment rate rose sharply, and then "forced" the Fed to cut interest rates. But the Federal Reserve does not think so, in the past week in the U.S. Treasury Department, the Federal Deposit Insurance Corporation (FDIC) and the Federal Reserve under the close cooperation of the three parties, the banking sector storm temporarily controlled, coupled with the U.S. residential sector balance sheet health, systemically important financial institutions remain stable, the possibility of a repeat of the 2008 subprime mortgage crisis seems relatively low.

2.Eurozone March manufacturing PMI preliminary value of 47.1, well below economists' expectations of 49.0, a new low since October 2022.

Interpretation: On the other hand, business activity in the Eurozone unexpectedly accelerated in March. The services PMI jumped to a 10-month high of 55.6 from 52.7 last month, well above forecasts of 52.5, as consumers continued to expand their spending on services. The composite PMI, seen as a good indicator of overall economic health, rebounded to 54.1 from 52.0 in February, above economists' forecasts of 51.9 and also at a 10-month high. On the other hand, business activity in the Eurozone unexpectedly accelerated in March. The services PMI jumped to a 10-month high of 55.6 from 52.7 last month, well above forecasts of 52.5, as consumers continued to expand their spending on services. The composite PMI, seen as a good indicator of the overall health of the economy, rebounded to 54.1 from 52.0 in February, above economists' forecasts of 51.9 and also at a 10-month high. An important contributing factor, according to the analysis, was the further recovery of the financial services sector in the Eurozone. Compared to the end of last year, real estate activity in the eurozone showed a significant upturn. The tourism, industrial services, IT and healthcare sectors also showed corresponding growth. An important contributory factor, according to the analysis, was the further recovery of the financial services sector in the euro area. Compared to the end of last year, real estate activity in the eurozone showed a significant improvement. The tourism, industrial services, IT and healthcare sectors also showed a corresponding increase. It is clear that economic activity in the euro area will not be directly affected by the banking crisis in the US and Switzerland, as the region's banks have not been damaged. However, economic activity could still be hit by the decline in confidence associated with the crisis.

3. Friday, the U.S. Treasury's Financial Stability Oversight Council (FSOC) meeting announcement said the U.S. banking system remains sound and resilient despite the stresses faced by some financial institutions. The meeting did not include a commitment to provide protection for uninsured deposits in any banks that fail this year, as many investors had expected. Later in the day, Biden took a stand on the regional banking crisis, saying he believed that US regional banks were in good shape and did not expect any major crises in the future.

The Financial Stability Oversight Council (FSOC), a group of regulators, agreed at a meeting on Friday that the US banking system remains "sound and resilient" despite the pressures on some financial institutions, the US Treasury said on Friday 24 March. In a press release following the closed-door meeting, the US Treasury Department, the convener of the meeting, said FSOC participants were briefed by New York Fed staff on market conditions. The Committee discussed the current state of the banking sector and noted that while some financial institutions are under pressure, the US banking system remains sound and resilient, the press release said. The Committee discussed current conditions in the banking sector and noted that while some financial institutions are under pressure, the US banking system remains sound and resilient. This is the first time since this week that US President Joe Biden has taken a stand on a regional banking crisis. After the collapse of Silicon Valley Bank as a result of the sudden outflow of such funds, US regulators are under increased pressure, with depositors demanding that regulators such as the Treasury Department make it clearer that they will be prepared to provide guarantees for uninsured bank deposits. While Yellen and Federal Reserve Chairman Jerome Powell have repeatedly said US bank deposits are safe, Yellen's indication earlier this week that regulators are not unilaterally prepared to provide a full guarantee triggered a stock market sell-off in bank stocks. In addition to pressure from investors, US politics is also putting pressure on regulators. On Thursday, some senior Republican lawmakers on the US House Financial Services Committee requested details of the FSOC's closed-door meeting on 12 March, when Yellen and her counterparts were discussing a range of measures in the wake of the Silicon Valley bank collapse. the FSOC, whose members include the heads of the Federal Reserve, the Federal Deposit Insurance Corporation and several other regulators, was held simply as a coordination meeting of US regulators mechanism. But Friday's press release on the meeting apparently fell short of many expectations.

Market Dynamic Tracking

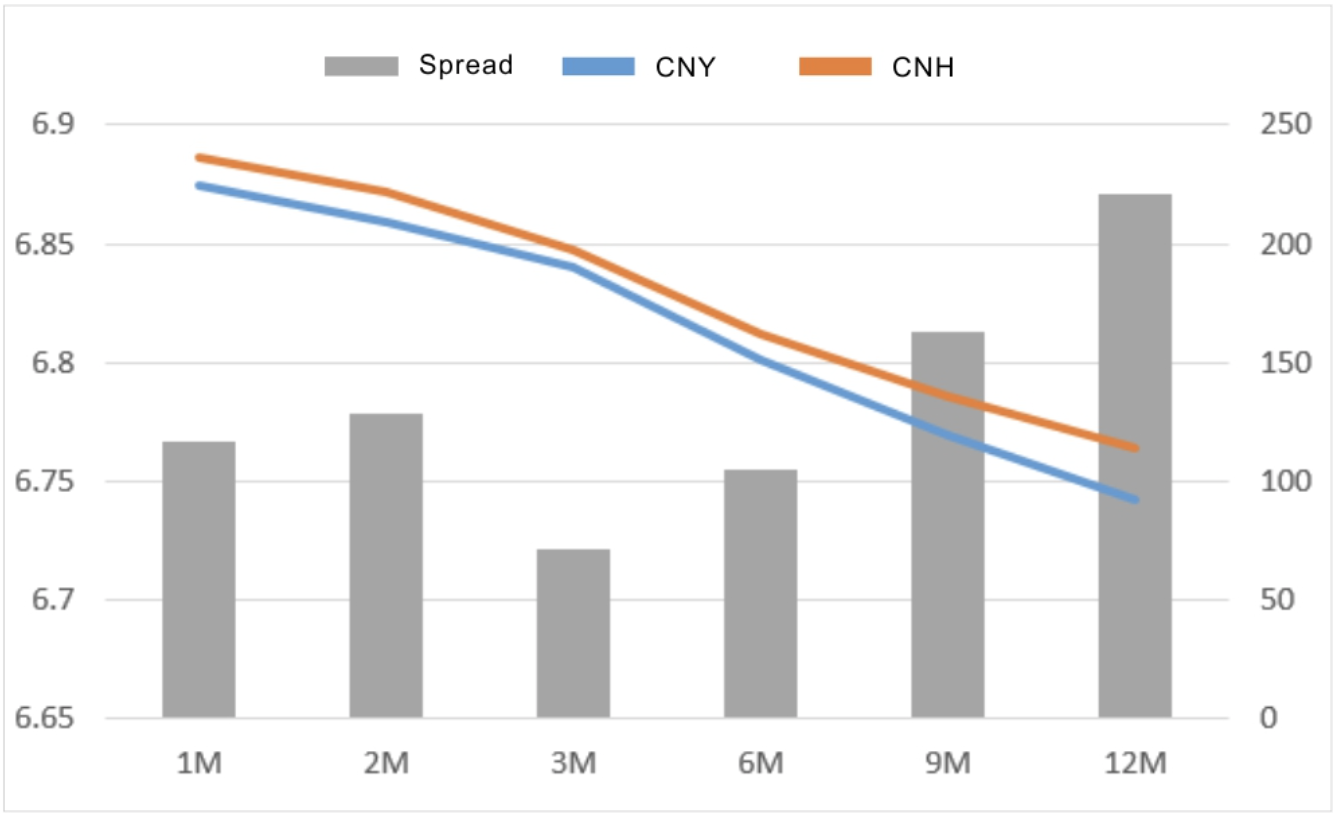

CNH and CNY Spread

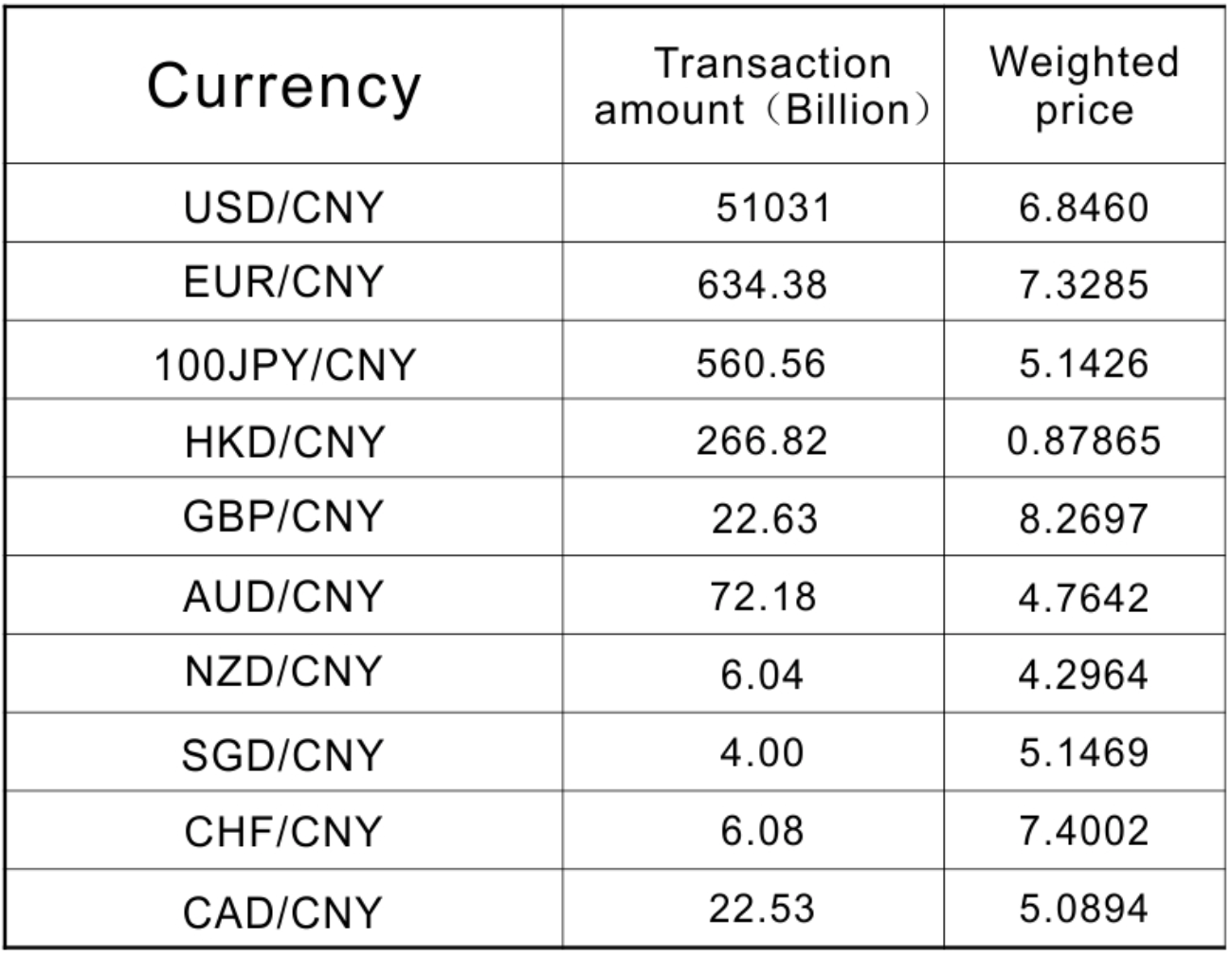

Spot trading volume of important currencies of RMB